"What have I told you since the very first day you set foot in this office? There are three ways to make money in this business. Be first. Be smarter. Cheat. Now I don't cheat. And although I like to think that we have some pretty smart people in this building, it sure is a hell of a lot easier to just be first."

"Sell it all. Today."

Margin Call (2011)

We're all familiar with the Golden Rule -- Do unto others as you would have them do unto you -- and I don't think it's a stretch to say that its message of reciprocity and empathy is the bedrock of human civilization, certainly of Judeo-Christian thought. As Hillel the Elder said, "What is hateful to you, do not do to your neighbor. That is the whole Torah. The rest is commentary."

There's a variation of the Golden Rule -- I don't think it's a stretch to call it a perversion -- that is the bedrock of the business of Money, a business that goes by the shorthand of 'Wall Street'. This not-so-Golden Rule is the source of pretty much all of the unexpected Bad Things that happen from time to time in markets, where there's a shock to the system that 'no one could have foreseen', like a sudden crash in the price of something or like a run on a bank or an investment firm. That perversion of the Golden Rule is this:

Do unto others as they would do unto you. But do it first.

It's a perversion of the Golden Rule in two ways. First and most obviously, it's got that extra sentence about doing the thing before the other guy. But second and less obviously, it's normative-negative, which is a ten-dollar phrase to say that it's not talking about doing good things ('as you would have them do'), but is pretty obviously saying that you should do something that will actively hurt the other guy.

If you're in the business of Money for more than a nanosecond, you will see this not-so-Golden Rule in action all around you. More to the point, if you want to stay in the business of Money and be successful in the business of Money, you must adopt and live by this not-so-Golden Rule yourself. Seems harsh, I know, but as Hyman Roth so aptly put it in The Godfather, Part II, "this is the business we have chosen."

And it IS harsh. You can rationalize it by saying that he would have done the same thing to you if the situation had been reversed -- and you are almost certainly correct in that assessment! -- but the fact remains that YOU are doing the negative thing to the other guy. If you're a thinking, feeling, non-sociopathic human being you will feel bad about doing that negative thing, but you will also get over it pretty quickly because it is absolutely, unequivocally, 100% the rational thing to do, and if you've been entrusted with managing Other People's Money you have a moral if not legal obligation to do that rational thing despite the blecch feeling you have inside.

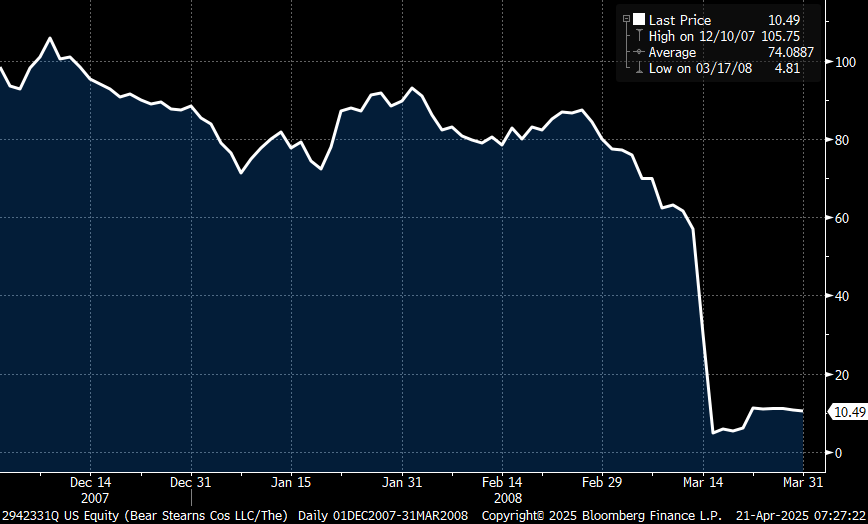

The first time I experienced that blecch feeling keenly was in December 2007 when I called our Bear Stearns rep and told him that we had decided to leave Bear Stearns as our hedge fund’s prime broker and we were pulling our money out. A prime broker is basically the 'bank' for a hedge fund. They provide lots of services, but the main ones are that they lend you money against the value of your portfolio so that you can buy more stock without using actual cash to go long (bet that the stock price will go up), and they locate and secure the shares of stock that you have to borrow in order to go short (bet that the stock price will go down). In exchange you pay them interest on the 'leverage' you used to buy more stock, just like you'd pay interest on a bank loan, and even more importantly from their perspective (and also just like a bank) you 'deposit' your stock holdings and some cash with them, which they can use to fund the loans and leverage they're making available to other clients. It's arguably the most important counterparty relationship that most hedge funds will have, certainly back then, and it's a very profitable business for Wall Street investment banks, certainly back then.

What you need to understand is that I didn't like working with Bear Stearns ... I loved working with Bear Stearns. Loved the people, loved the attitude, loved the business terms. Bear Stearns was famously unafraid to take a chance on up-and-comers, both in its hiring of non-pedigreed entry-level employees (preferring, in legendary CEO Ace Greenberg's words, to hire people who were 'PSDs': poor, smart, with a deep desire to be rich) and in its willingness to work with non-pedigreed hedge funds like mine. To be sure, it helped that the larger firm of which my fund was a part was filled with ex-Bear employees, all friends who would vouch for me and my partner. This was back in the day when vouching for someone meant something. It still does, I suppose, but a lot less than it used to. Bear stepped up to be our hedge fund’s prime broker from the very start, putting real time and real effort into a dinky little fund when nobody else would. Yes, they made good money off our business as we grew into a non-dinky fund, but I also owed a personal debt of gratitude to Bear Stearns for taking a chance on us.

And it didn’t matter.

Once I figured out in late fall of 2007 that if we had a nationwide decline in home prices, Bear Stearns faced enormous potential losses in the mortgage-backed securities that they owned, losses big enough to wipe out the entire bank because of their internal leverage on assets – or rather, once I suspected that I had figured this out, because you never know this stuff for sure unless you're on the inside -- then I knew for a certainty that it was only a matter of time before other prime broker clients of Bear Stearns would come to the same suspicion. And once that word got around -- that there were doubts and suspicions about Bear Stearns as a counterparty -- then I knew for a certainty that what would start as a trickle of clients taking their money out of the prime brokerage 'bank' would become a stream and then a river and then … well, then the dam breaks and the investment bank fails and if you’re still there as a prime brokerage client you get really, really hurt.

It didn't matter if I was right about Bear Stearns and the risks to their balance sheet. I was, but I swear that didn't matter. What mattered was the not-so-Golden Rule of Wall Street. What mattered is that you must act first when you have even a suspicion of counterparty risk, well before you know for sure whether or not you are 'right' about that risk, because everyone else on Wall Street will act first if you don't. And if you don't act first, or at least early ... if you wait until you're sure that there's a counterparty risk ... well, you're screwed.

In December 2007, Bear Stearns still traded for over $100/share. In three months, it was below $5, before finally being taken out by JP Morgan for $10/share in a mercy killing. From suspicions to lights out in three months. Life comes at you fast when the not-so-Golden Rule of Wall Street comes into play. Getting out when we did saved our fund untold hassle and legal tie-ups, gave us the time to move to another prime broker out of strength and not desperation, and set us up for a career-making year in 2008.

Is this sort of run on the bank a self-fulfilling prophecy of doubt and ruin? Yep. If everyone had just kept their prime brokerage account in place would Bear Stearns have survived? Maybe. Do you have a choice but to get out before everyone else does, no matter how much it pains you personally and no matter how much your getting out might accelerate the sad and disappointing outcome? Nope. This is the business we have chosen.

Incidentally, you might wonder if my Bear Stearns rep pleaded with me to keep my money in place. Yes, he did. You might wonder if he was angry when I said that I was out and there was nothing that would keep me in. No, he wasn't. He was disappointed but he wasn't angry. He understood the Rule. He knew the score. Absolutely if the situation had been reversed he would have done the same thing.

Why am I telling you this story?

I'm telling you this story because I think that Trump a) recognizes he made a mistake by overplaying the tariff card, b) is sidelining the ideologue pro-tariff crew like Navarro and Miran, and c) is actively looking for off-ramps and de-escalation in the China trade war. I think he may find an off-ramp and de-escalation in the China trade war, and that would be a wonderful thing for the United States and the world.

And it doesn't matter.

I'm telling you this story because right now, no matter what happens in the US-China trade war, Wall Street is getting suspicious about counterparty risk with the global 'prime broker' that is the United States Treasury.

I'm telling you this story because if you stay focused on the US-China trade war and its ups and downs and its are-they-talking or aren't-they-talking, you will miss the far bigger story of Wall Street taking its 'deposits' of stocks and cash out of the 'prime broker' that is the United States and moving them to other developed markets like Japan or Europe.

I'm telling you this story because right now we are in the early stages of a bank run on the United States and the US dollar, and now that it's started everyone in the business of Money is going to join in, including patriotic American financial advisors and patriotic American institutional consultants who will feel blecch about it but will do it anyway, not because they want to but because they know the Rule.

Now that it's started, it's all going to happen faster than you think it can.

What is IT? It's capital flight out of the United States, not just from central banks or sovereign wealth funds or foreign pension funds selling their US assets like Treasuries (although yes, that, too!) but even more so from American investors and allocators, large and small, who know the Rule.

Capital flight to where? To developed markets outside the US, like Japan and Europe. To real assets like gold first, property and oil second, especially outside the US, especially if you can use dollars to buy them. To emerging markets if they're your home market. God help us, capital flight to Bitcoin!TM.

Case, case, case … cluster, cluster, cluster … BOOM! Like I wrote five years ago, that's the way we humans experience the exponential growth process for viral pandemics. Once it gets to the cluster, cluster, cluster stage the BOOM! is inevitable.

It's the same thing with a bank run.

Yes, I understand that this capital flight originated with tariff policy and tariff policy can be reversed, but the 'virus' that causes a bank run against an entire country and its currency isn't a single policy! It's a lack of credibility in the entire government. It's a suspicion that this government 'bank' cannot fund itself in the face of declining revenues (recession and tax cuts), increasing expenditures (trillion dollar defense budgets), and disappointing fiscal initiatives (meager DOGE cuts, insanely overestimated tariff revenues). It's the certainty of everyone in the business of Money, everyone who knows the Rule, that what we are going to experience is a rush to the exits by every currency counterparty to the United States, including domestic US asset owners, which creates a self-fulfilling prophecy that the United States won't be able to fund itself.

You know who understands this, because he was there when there was a VERY similar bank run against the Bank of England in 1992? Scott Bessent, that's who! It's just bonkers to me that someone who was on the other side of this doesn't see what's coming down the pike. Or worse, that he DOES see what's coming down the pike and is either too much of an ideologue or too powerless to stop it. Let that sink in, as the kids would say.

The trajectory of all this, just as it was with the British pound in 1992 or the Mexican peso in 1994 or the Thai baht in 1997, is a violent devaluation of the US dollar against … well, everything. And I believe in an attempt to stop THAT we are going to see increasingly apocalyptic responses from Trump, like announcing that the US will start selling its gold reserves (but will maintain physical custody, for your own security, you know). Capital controls. Short-selling bans. Banking and market ‘holidays’. Yield curve control and direct monetization of the debt. Buying Bitcoin. Nothing is off the table. Nothing is too crazy to consider.

Is it inevitable that things get THIS crazy? No, of course not. There's still time to start building credibility instead of destroying it. Fire the woke-right economic clown car advisors, shut up about firing Powell, take an L with Europe and Japan ... you know, stuff that will feel like death to Trump but would make an enormous difference to people in the business of Money. Maybe more realistically, there's protection from an outright bank run coming from the fact that the allocation recommendations of institutional consultants and the model portfolios of gigantic financial advisory firms move like molasses. And honestly, up until this past week that's where I was on all this -- that the current dollar crisis would at least stop accelerating because of the inertia of the really giant pools of capital, and that the loss of trust in the United States would be more of a multi-year melting iceberg thing than a Greenland-ice-sheet-slides-into-the-Atlantic thing.

But then I remembered Bear Stearns. Then I remembered the Rule.

Do unto others as they would do unto you. But do it first.