Leonid Brezhnev “during a festive demonstration on Moscow’s Red Square” (source: Sputnik)

Back in the day, Pravda was the official newspaper of the Soviet Communist Party and Izvestia was the official newspaper of the Soviet government. They were, in the lingo of these matters, “organs” of the Soviet Union. Today Pravda is the official newspaper of the Russian Communist Party and Izvestia, self-described as a “Russian national newspaper”, is owned by Gazprom. LOL.

Speaking of the Soviet Union, I’m old enough to remember when a sclerotic and failing Leonid Brezhnev was the perfect symbol of the sclerotic and failing USSR, when the advanced age and decrepitude of Soviet leadership was a global joke. Wanna guess how old Brezhnev is in this photo, taken two years before his death? He’s 73.

Anyhoo …

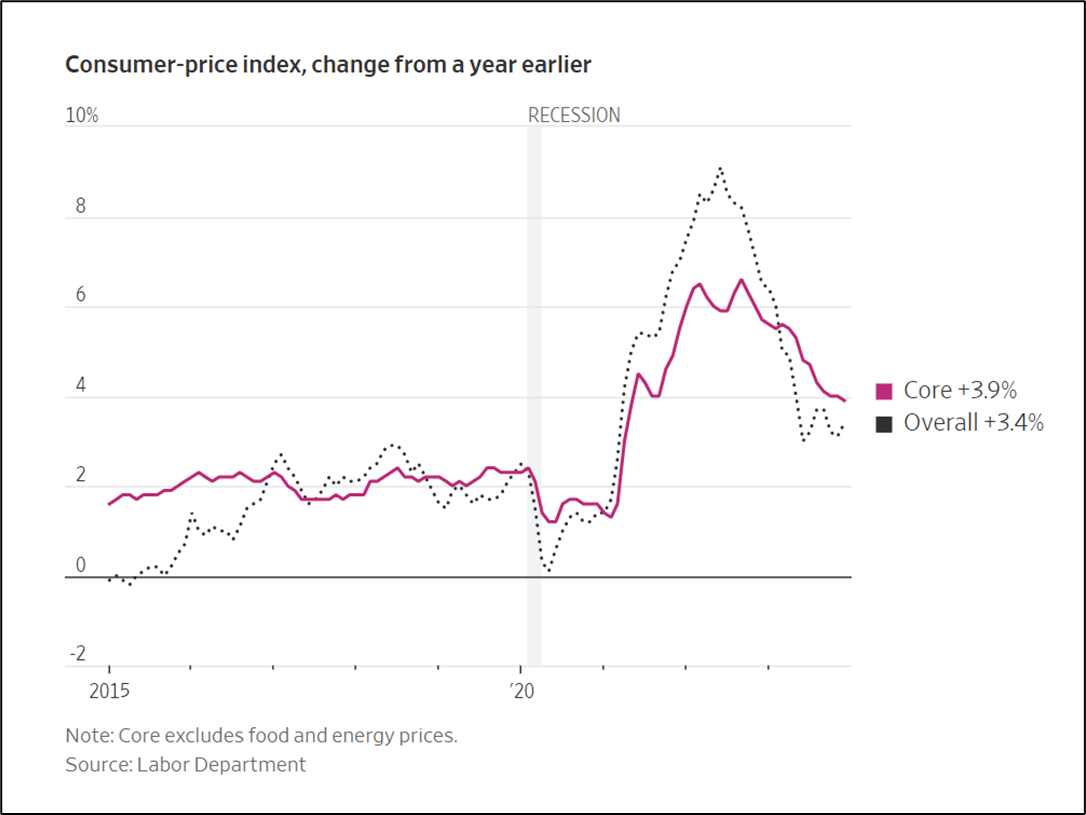

Last month I wrote a note about media framing of the monthly CPI release. The point was that the Wall Street Izvestia was altering its graphical presentation of CPI reports to encourage the perception that inflation rates were continuing to fall rapidly as opposed to flatlining over the past six months. Money quote from Non-Linguistic Inflation Framing in the Wall Street Journal:

Today both Wall Street and the White House are determined to tell you a story that inflation is over, mission accomplished. Wall Street because they want a cheaper price of money and the White House because they want to win an election.

It’s not a lie, per se, but it’s not a truth, either. It’s all just story, all the way down, not just in their words but in their pictures, too.

For the past year, since March 2023, the WSI has graphically emphasized the core inflation rate, officially because everyone knows that everyone knows that core inflation is what you should really be paying attention to and overall inflation is for chumps, truthfully because core inflation rates have continued to decline since last June and so present a narrative-appropriate picture, as opposed to overall inflation rates which bottomed out last summer. The presentation emphasizing core inflation looks like this from a month ago, with a dark red line for core inflation and a faint dotted line for overall inflation:

Jan 11, 2024: WSJ - Inflation Edged Up in December After Rapid Cooling Most of 2023

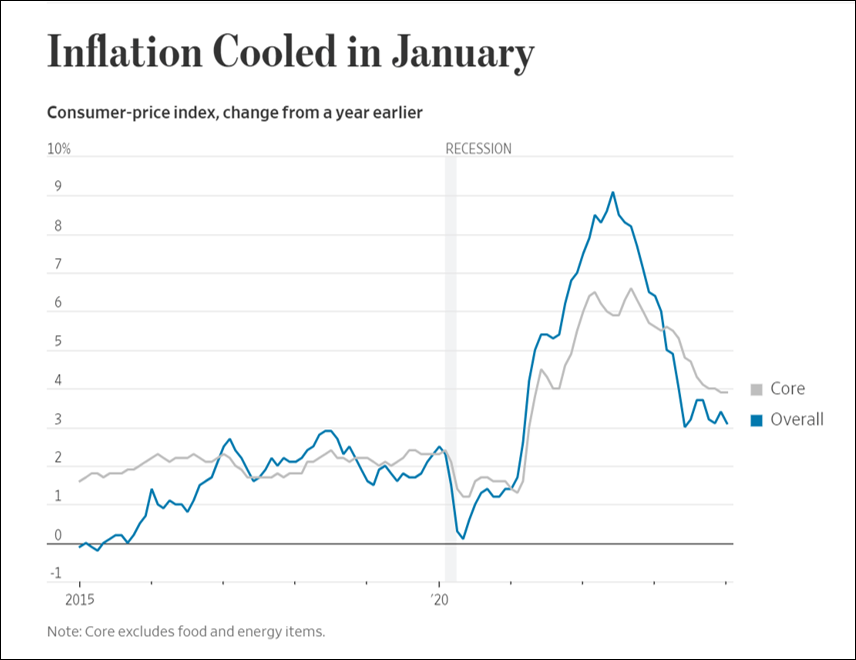

Honestly, I didn’t think that it was possible for the WSI to outdo themselves on this score with yesterday’s coverage of the CPI release, but well … here we are. Yesterday, when core inflation rates flattened and overall rates ticked down, the WSI reversed course and graphically emphasized overall inflation to justify the narrative-appropriate “Inflation Cooled in January” headline.

I took this as a screenshot soon after the 8:30am data release, but I don’t think you can find this headline on the WSI today. Once markets tanked and the Prime Directive of financial news media kicked in – must provide the WHY for a market move – the WSI editors replaced “Inflation Cooled in January” with “Hotter than Expected Inflation Clouds Rate Cut Outlook”.

But do not fret, gentle reader! Yesterday’s inflation concerns can be safely ignored, as WSI opinion leaders are only too happy to inform you this morning.

At least the Wall Street Izvestia is forced to respond to market realities in its efforts at nudge.

For the Washington Pravda it’s all Fiat News all the time, where your reality is always declared to you and never actually lived.

And no, this isn’t just a case of an over-zealous headline writer. Here’s the first line of text: "Prices cooled further in January, offering the latest sign that inflation has eased significantly since its pandemic-era surge".

I’d say that you literally can’t make this up, but in fact it was literally made up. Pure MiniPlenty language. Not a lie, per se, but also not a truth. Or at least not the truth that matters: inflation is well embedded at a point well above the Fed’s target.

Is this a terribly inconvenient truth for Wall Street and the White House? Of course it is, and rest assured that every possible data point going forward will be interpreted and massaged to fit the desired storybook ending of multiple rate cuts in 2024.

But for those of us who have to live and invest in the real world, it’s never been more important to see the story-telling effort with clear eyes.