Matt Zeigler is a Managing Director and Private Wealth Advisor with Sunpointe Investments, and he’s been helping people with their money for more than 15 years. But he’s also one heck of a writer, which is why we’ve brought him on board to help us at Perscient. Matt publishes an excellent daily note called Cultish Creative, which you can subscribe to here and you can read every day on Epsilon Theory!

You can contact Matt at matt@perscient.com and on Twitter at @cultishcreative.

Some of the coolest behind-the-scenes finance podcast moments I’ve had in the past few years have included hearing really smart people explain some very odd detail to me, and then watching the market figure it out in the days/weeks/months that followed. Inevitably, those moments always make me wonder where the guest’s little nugget is in the data, and how else we could present it because the market hasn’t figured it out yet. And, up until very recently, it was really cool to hear it and almost impossible to demonstrate it in an easy way.

That all changed for me a few months ago.

I started working with my friends at Epsilon Theory on their new data-crunching/presenting venture, Perscient, and … they have the charts for it. They’re called “storyboards” and they’re ways of taking snapshots of evolving narratives from the gigantic database of media/social/internet they’ve built over the years, and putting them in a graphic.

Think of storyboards as a way to track narratives in real-time so you can see reality before the story catches up. There’s a million use cases for these. To highlight some of their depth, I had the idea to take expert insights from some of my interviews and showcase corresponding data sets that bring life to what these really smart people are telling me.

In time, people who want to sign up will be able to create their own dashboards around any narrative you want to track (check out the “Confirm your Intuitions” link here if you haven’t already). What you’ll see below is how powerful this gets when you can literally watch market sentiment shift in real-time around the ideas that brilliant people are discussing. Each insight becomes independently shareable, but together they show you what it looks like when you can track the gap between expert reality and Common Knowledge as it happens.

But Perscient is their idea, and (trust me, I know) that’s a tool I can use but can’t contribute much to building. What I can help with is how we talk about the tools. Enter a whole new Epsilon Theory offshoot – a space where a group of super talented authors and contributors and I will be experimenting with telling the stories we’re finding in this massive library of information.

One of my first initiatives is to start mapping interesting perspectives from podcast guests across the Perscient database. It’s been an intuition up to this point – that expert insights occasionally pick up on signals that mainstream data might be missing entirely – and now, it’s staring right back at me.

Below are five insights from my recent interview with Daryl Fairweather, PhD, Chief Economist at Redfin, author of “Hate the Game: Economic Cheat Codes for Life, Love and Work” and previous guest on Intentional Investor, joined me on Excess Returns for a deep dive into what’s happening in real estate.

What you’ll see is how her insights about the housing market — things she’s observing that go beyond mainstream economic data — get data-rich confirmation from the narrative-tracking power of a Perscient storyboard.

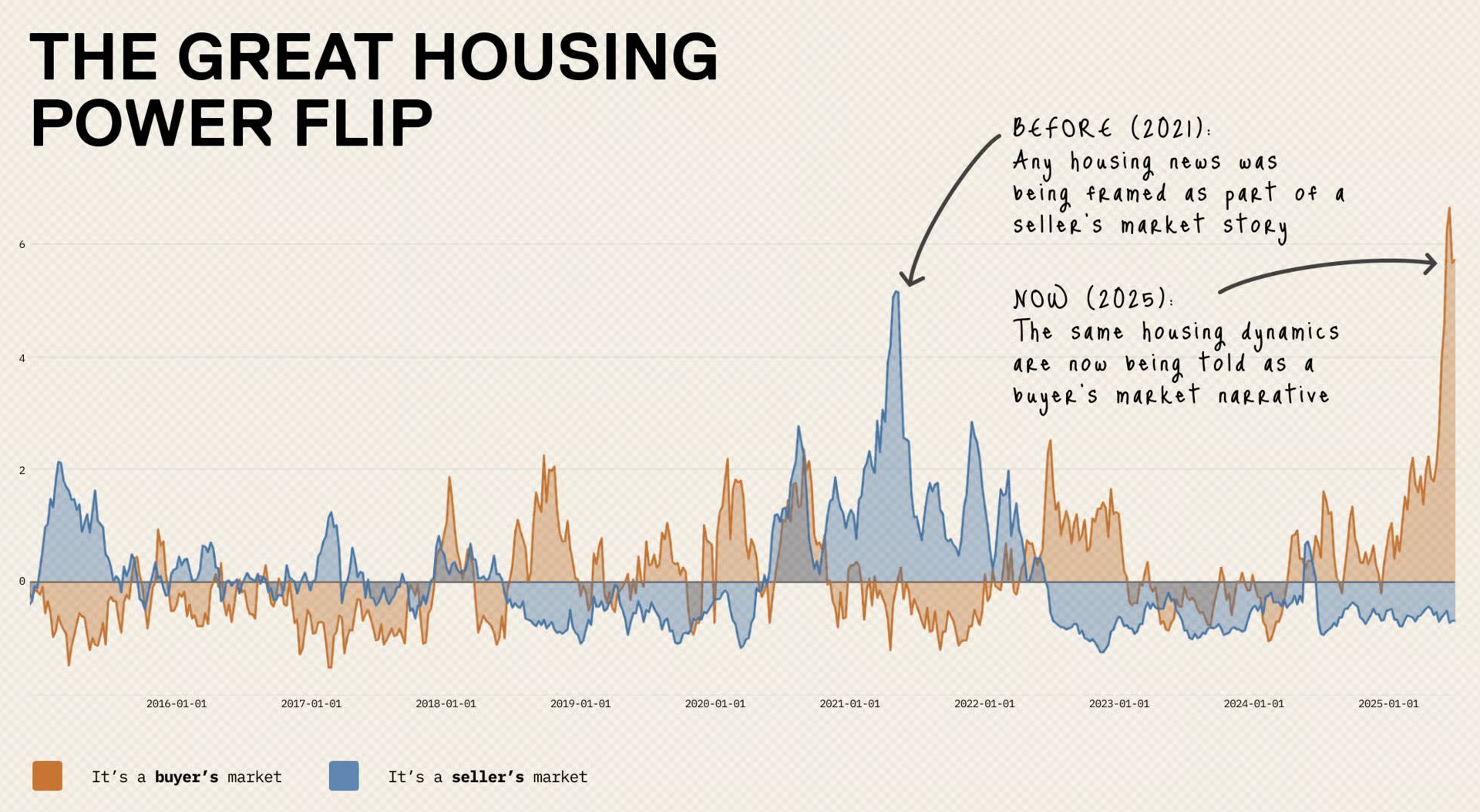

1. The Housing Market’s Power Shift

“More sellers than buyers” is markets media 101 stuff. In any fast-trading, highly liquid market, it’s usually a cop-out for doing some more thoughtful analysis. It’s obvious that more sellers than buyers showing up to trade will push prices down, but, in liquid markets (re: with LOTS of players), there are a million tiny little reasons why these imbalances can, will, and do happen from time to time.

Real estate, however, is not a highly liquid market. Your house doesn’t sell a billion times a day like shares of some large cap stock. So when we’re studying an illiquid market, we know trends like “more sellers than buyers” can reveal emergent stories worth tracking.

The housing shortage narrative says sellers have the power. If there’s not enough houses, sellers can demand more for what they’re trying to offload and buyers have to accept it. But our Perscient data shows the “buyer’s market” narrative reaching its most extreme levels since 2015 – and it’s happening right now.

What about the gap between listing prices and sales prices? It’s currently about $50k-wide on average. And here’s the kicker: this massive sentiment shift toward buyers isn’t showing up in prices yet. When markets price reality before narratives catch up, smart money pays attention to the lag. If you’re buying or selling right now, take note – the power dynamic has already flipped, even if the price tags haven’t caught up yet.

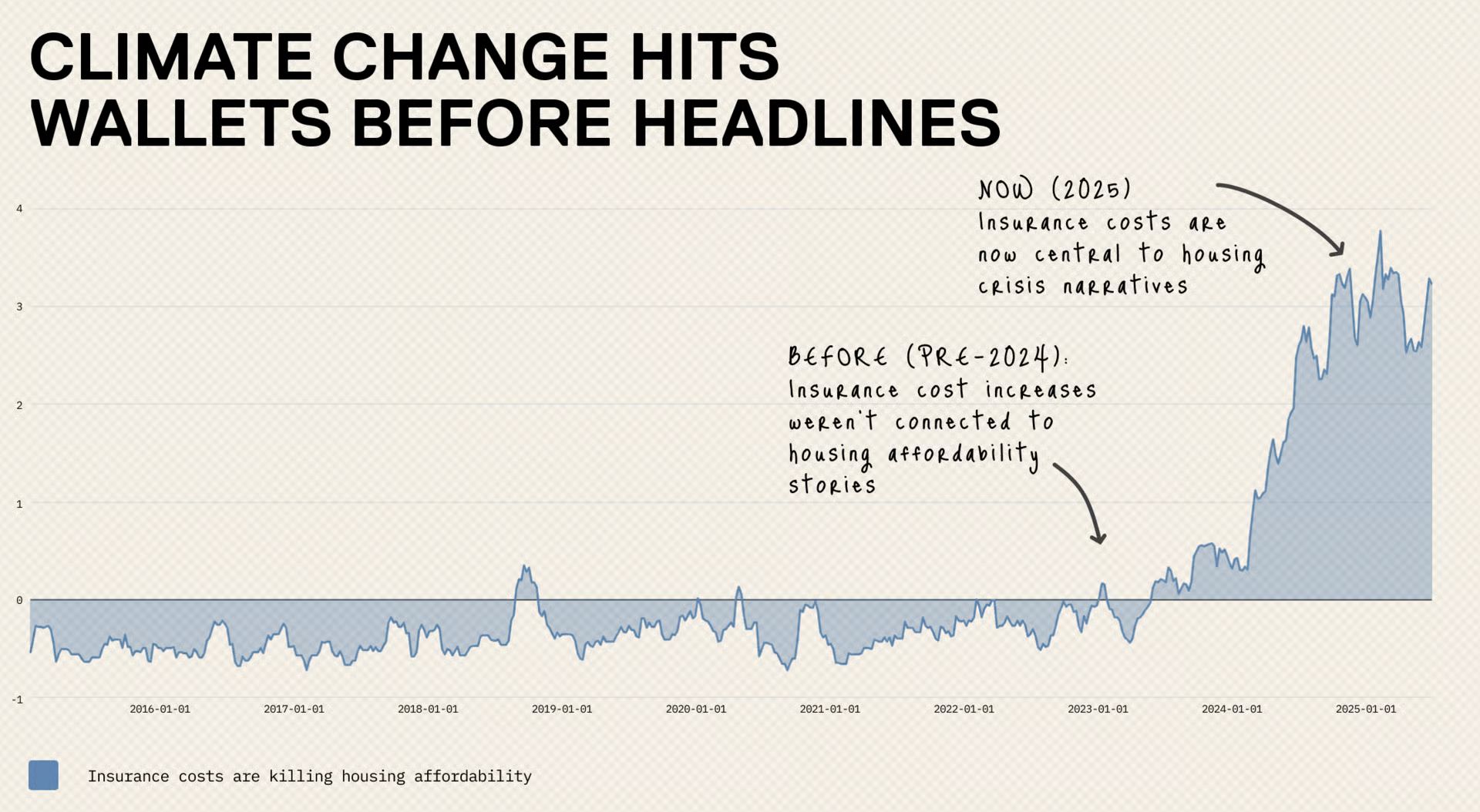

2. Climate Change Hits Wallets Before Headlines

Housing is the first place that people are going to feel the economic costs of climate change because it will show up in their insurance, it will show up in their property values.

Daryl Fairweather, PhD

You can’t discuss climate change without it becoming political. Here’s the reality: flooding and storms change what it costs to insure homes, impacting total ownership costs. Florida leads the buyer’s market trend not because of abstract future climate concerns, but because of concrete present-day insurance costs and HOA fee spikes.

Our Perscient data shows “insurance costs are killing housing affordability” hitting levels three times stronger than its 2018 peak – and it’s been hovering at these massively elevated levels for over a year now. Insurance and HOA fees aren’t sexy topics, but that’s exactly the point – climate change hits your wallet through boring paperwork before dramatic headlines. The narrative finally caught up to reality in 2024, but the cost pressure has been building steadily since early 2023.

Nationally, purchase cancellations hit 14.3% recently, partly because buyers are discovering post-offer that they need big-ticket roof replacements for insurance coverage. The story that climate change is coming for real estate isn’t about where the new beach front property is going to be – it’s already reshaping transaction patterns where total costs are changing fast, and our data shows this trend has staying power.

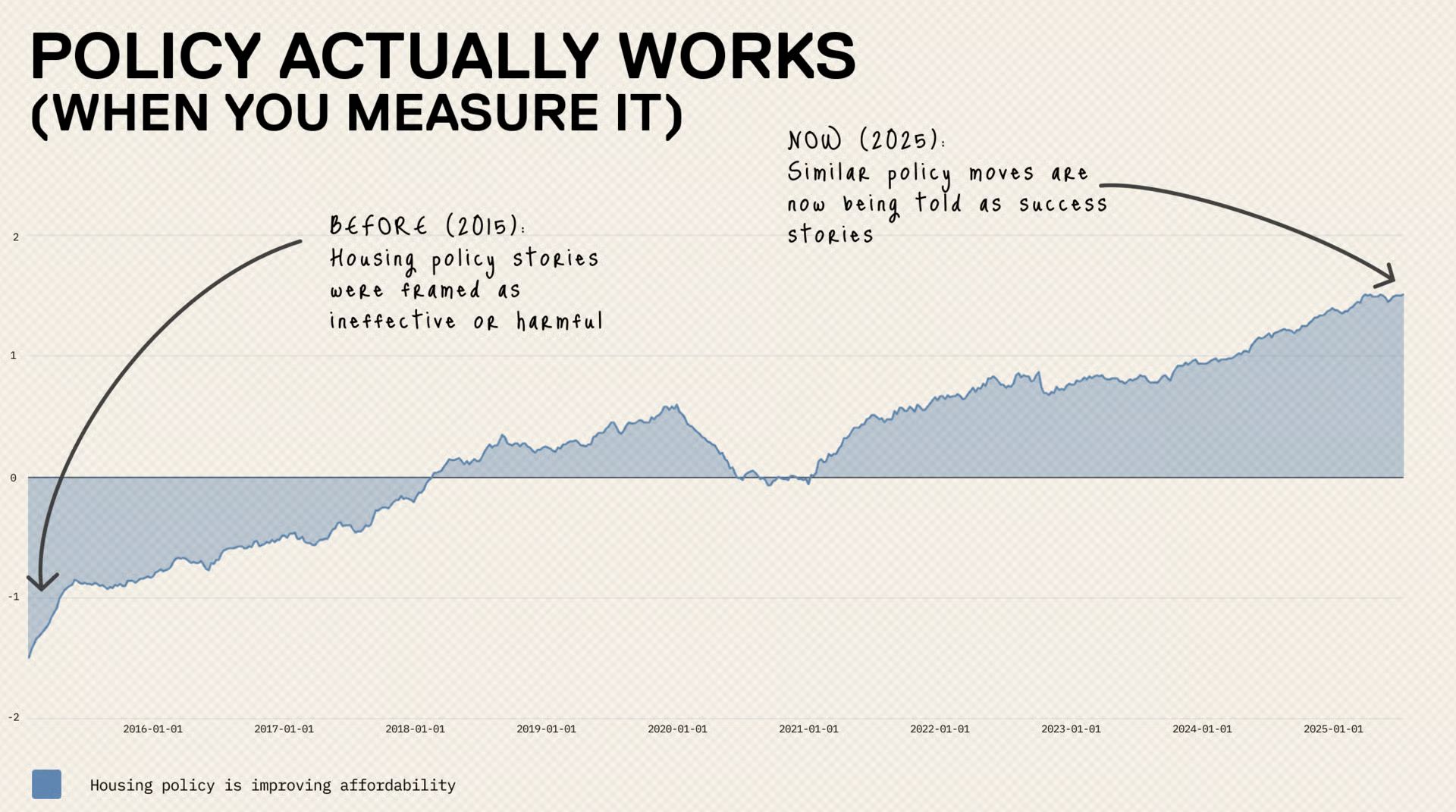

3. Policy Actually Works (When You Measure It)

Austin rents fell 9%, Minneapolis down 6%. The two metros that had the largest drops in rents had been some of the metros that have done the most work in terms of zoning reform.

Daryl Fairweather, PhD

Housing is slow by design. Reforms are tricky, projects take decades, and NIMBYs almost always win. But these zoning reform results? They’re producing measurable outcomes in years, not decades.

Our Perscient data tells a fascinating story: from 2015 to early 2018, “housing policy is improving affordability” narratives were actually hurting affordability sentiment. Then something shifted. After COVID flattened the signal, we’ve seen a dramatic turnaround since 2021 – with the narrative now hitting its most extreme positive levels on record, especially since early 2025. The data shows policy reformers finally figured out how to move the needle, and markets are pricing in real results.

Austin’s density reforms and Minneapolis’s single-family zoning elimination created real affordability improvements while everyone argued about theoretical solutions. Some politicians are going to notice this very populist theme – and it delivers measurable results within election cycles, not decades. Markets rewarded policy action with price signals before policy wonks noticed, and our data shows this trend has serious momentum. Effective governance shows up in rent rolls before research papers or campaign promises.

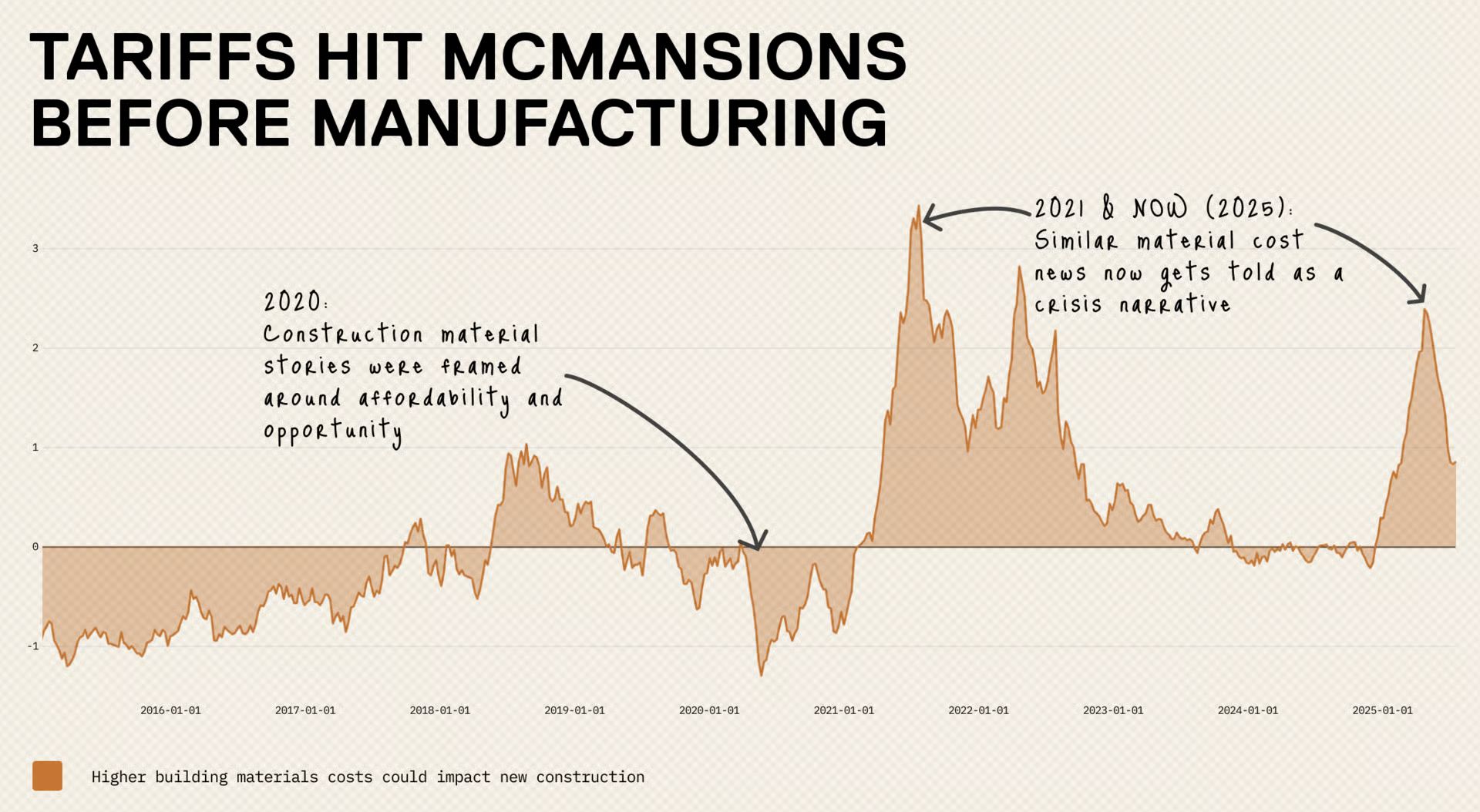

4. Tariffs Hit McMansions Before Manufacturing

One in four Americans report canceling major purchases like homes due to tariff policy uncertainty.

Daryl Fairweather, PhD

Trade war narratives focus on factories and farmers. The reality is, tariffs immediately impact the largest consumer purchase most Americans make. The threat alone creates impact at multiple levels – mortgage rate volatility, construction material cost uncertainty, job security fears – and they all show up, even if indirectly, in housing transaction cancellations.

Our Perscient data shows “higher building materials costs could impact new construction” following a predictable pattern: the signal tanked during early COVID, then spiked massively as supply chain disruptions sent construction costs rocketing. It eased back to neutral through 2024, but in 2025 – likely related to tariff uncertainty – it’s exploded again to near-COVID levels. People are genuinely worried about these costs, and the timing isn’t coincidental.

While economists debate aggregate trade effects, we can look to real estate markets to provide real-time signals of policy impact on consumer behavior. The housing market becomes a leading indicator of macro policy effectiveness, stealing thunder from traditional economic metrics. When construction cost fears spike this hard, it signals that tariff policy is already reshaping major purchase decisions – before the first factory closes or the first farm fails.

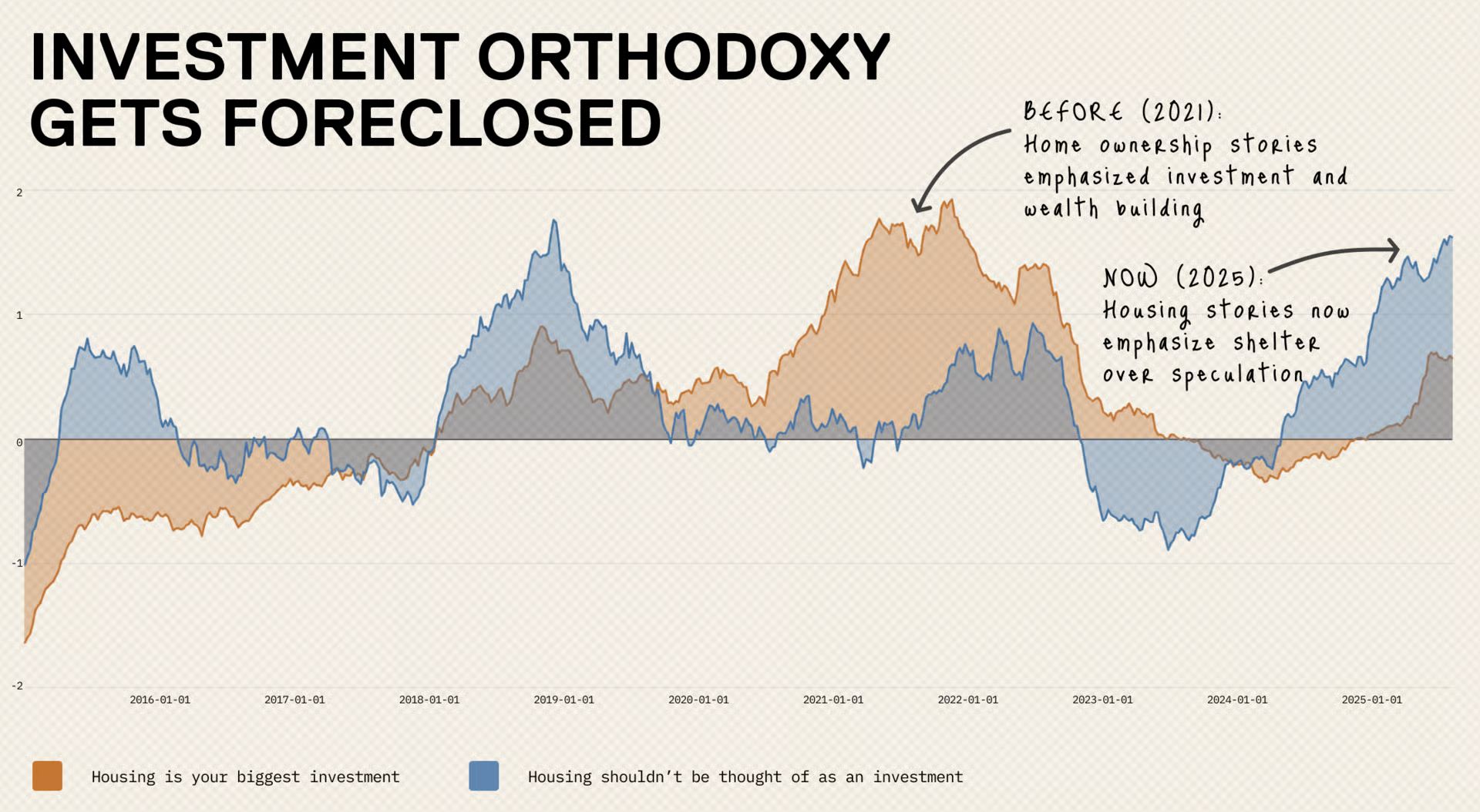

5. Investment Orthodoxy Gets Foreclosed

I don’t think that people should view their homes as an investment. The way that people have gotten so attached to this idea of their homes going up in value every year is really a detriment to housing policy and the economy as a whole.

Daryl Fairweather, PhD

The American Dream = home equity builds wealth, real estate is real, property values always rise. But treating homes as investments – especially with leverage – creates problems. Surprise, surprise – the financial crisis wasn’t that forgettable for homeowners who lived it.

Our Perscient data reveals fascinating gyrations in this narrative battle. From 2015-2018, people were actually pretty happy to not think of housing as an investment anymore. But then, from 2018-2023 – encapsulating the COVID surge – the “housing as an investment” story got heated again. It calmed down in 2023-early 2024, but since that point, the idea of home price inflation is back in the zeitgeist with renewed intensity.

Speaking as a financial planner, everybody needs shelter. You have to be careful about what words you use to describe that place. I have stories (including horror stories and borderline fairy tales) about how this can play out. When a real estate company’s Chief Economist tells you to temper appreciation assumptions during a period when our data shows investment mentality resurging, you pay attention. She’s not calling for another crash, but noting that slow-moving markets depend on expectations – and those expectations are cyclically overheating again. Shelter and speculation are very different things, and the data shows we’re forgetting that lesson.

Watch the full interviews with Daryl Fairweather on Excess Returns and Epsilon Theory