Back in the Brexit days, we and a lot of others speculated about how useful it might be to move trillion-dollar FX and sovereign debt markets by betting mere thousands on thin, illiquid Brexit prediction markets. OK, it was less speculation than it was outright and well-founded suspicion that this is precisely what some Mayfair macro funds were up to as we approached the referendum. If other traders were establishing positions and hedging on the basis of these prediction markets - even in small part, even subconsciously - then burning a few bucks on Betfair to give the only data moving around at all a push in a helpful direction had a near-infinite ROI.

Were people really taking and hedging positions based on the fluctuations of prediction markets? Almost certainly, although most would never admit it. For all their illiquidity, ca. 2016 prediction markets were the only games in town that weren't just another poll. There are no fundamentals in a referendum. There is no forward guidance from management. There's no proprietary cash flow model. There's how people vote, how they say they're going to vote, and the growing sense that how people say they're going to vote to a pollster who calls them on the phone like some sort of 20th century barbarian is worth a bucket of warm spit. The introduction of betting markets on political outcomes gave a data-starved audience a new, 24-hour, instant source of information that carried with it the very real benefit of representing real money that people were putting on the outcome they expected. More importantly, it created the common knowledge that prediction markets reflected earnest, properly incentivized, real people putting real money behind their opinions. Just like campaign rally photoshop and AI shenanigans, prediction markets became a way to change how the crowd saw the crowd.

In 2016, there wasn't a ton of money swimming around in these markets yet, and not a lot of people waiting in the wings to exploit it when a whale broke pricing. Up until the day of the vote, figure about £75 million in the most prominent such market. That means that the amount you'd have to stake to change the "probability" of Brexit or Bremain to a degree that bled over into the public consciousness was trivial. The amount you'd have to stake to have some impact on the actual real-life British Pound was non-trivial, but only until you compared it to the money you could make by earning 20% of some portion of the billion dollars of other people's money you were levering up 8 times betting on that impact.

It's a little different these days.

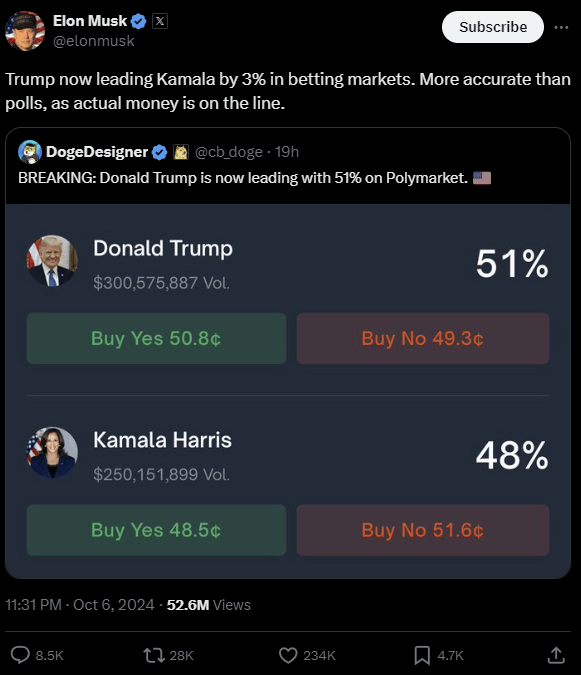

First, there's a lot more money at play. There are also a lot more participants looking to be liquidity providers to overeager newcomers. There are more platforms for taking bets, some of which try to control for whales and foreign interference and some of which do not. The amount of money required to move these prediction markets is no longer trivial. And unlike Brexit, the next most important political referendum in the world - the election of the President of the United States - doesn't have such a direct transmission mechanism to a small set of deep, tradeable markets. That is, despite the protestations of your friends and family on Facebook, it is rarely obvious how US election outcomes will be discounted and priced by market participants. Could you move Polymarket the amount it moved in the last few days with $10-20 million and a plan? Sure. Could you make enough money from doing so with enough certainty that it would actually go your way that you didn't care about losing the $10-20 million bet? Probably not. Even if you could predict what markets would be affected by one candidate winning, it isn't abundantly clear that leading polls or prediction markets by a lot a month ahead of a turnout election is always a desirable way to produce the outcome you wanted.

But what if you cared about something else? What if changing common knowledge itself was enough? What if you had a platform that could sustain a narrative at whatever limit arbitrage conditions and frictional costs created between different prediction markets?

I suppose it could be a coincidence that a bunch of money flowed into Polymarket on Trump to win immediately after Elon shared the stage with him in Pennsylvania. It might also be a coincidence that the accounts moving big blocks in the public ledger were also almost universally accounts that have historically been holders of Trump bets. It might be a coincidence that Polymarket's Series B raise in May was led by Founders Fund, whose CEO Peter Thiel has been a long-time mentor to JD Vance. It might even be a coincidence that the accounts that promoted this trend on social media were Elon fan accounts, and that Elon used it as an opportunity to reiterate for common knowledge purposes how important it is that you know these are real money accounts. The crowd you are watching is real, you see. More real than the polls.

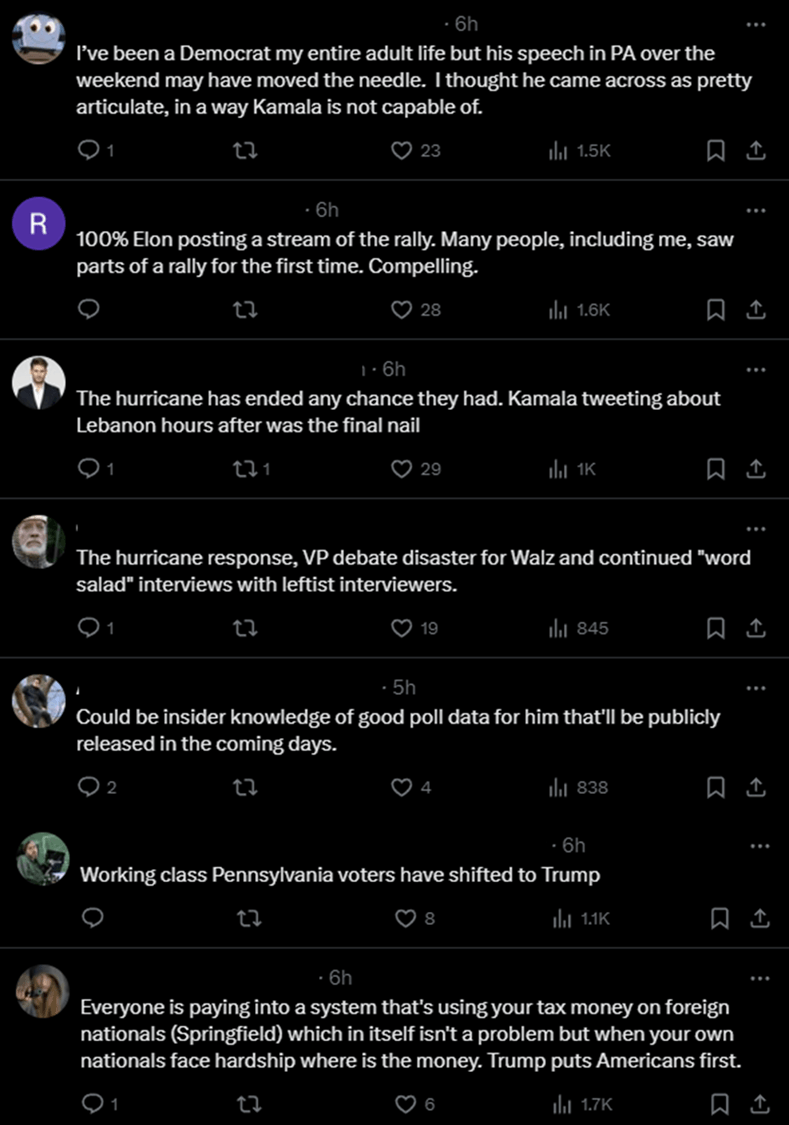

What is not a coincidence is how the new "common knowledge" was auto-tuned and crystallized immediately. See below a stream of contiguous responses to what I think was an honest and earnest question from famed Evo Psych professor Geoffrey Miller. A 6 point net swing manifesting over a few hours wasn't the result of chunky flows into an illiquid market; no, millions of Americans were just waking up after watching a speech and something something hurricane. Everywhere on every social media network and comment section to the dozens of articles covering this news, you will find responses very much like this.

It's not that those things are or aren't true or that they won't manifest in polls or the ballot box next month. It isn't as if smart people might not put some money down betting that a less-than-stellar response to Helene, a passive response to a brewing war between regional powers in a volatile part of the world, and some cracks in the Vance-is-a-weirdo narrative may have changed the game a bit. But that isn't what happened. Or at least it isn't what pushed the dramatic shift that made headlines, drew media attention, and created a viral surge of pundits claiming (or bemoaning) some rapid shift in the electoral climate. It isn't what changed common knowledge.

What changed common knowledge was a few people moving a lot of money in a thin market and the man with the biggest PA system in the world seeking to manufacture consensus by shouting into the void that this is real. It won't be the last time this happens. The more we embrace the lie being whispered in our ears - that social networks work to democratize influence and narrative formation - the more systematically we make ourselves part of their manufactured consensus.